Build Wealth, Protect Your Legacy!

You’ve worked hard to build wealth. We bring the strategy to protect it.

Engineered for Clarity. Designed for Legacy.

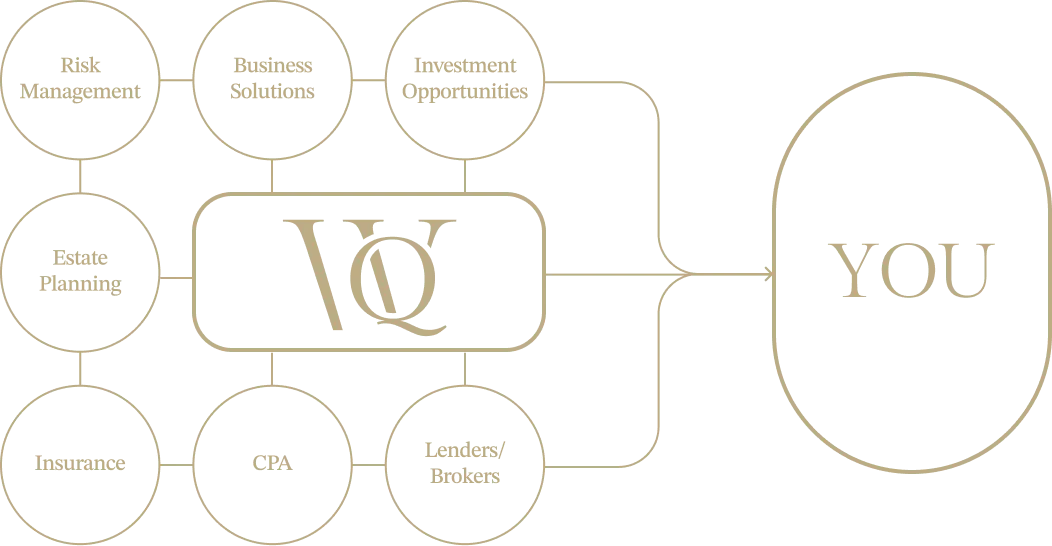

Still overpaying in taxes or unsure if your wealth plan is actually working for you? You’re not alone. Even high earners with a CPA and financial advisor miss key opportunities, not because they lack professionals, but because no one is connecting the dots. WealthQuant is not just another advisor. We’re a financial services firm built to uncover what others overlook. Our trusted network of CPAs, estate attorneys, and licensed professionals deliver complete, coordinated strategies that reduce taxes, protect income, plan for succession, and preserve long-term wealth. With the WealthQuant Blueprint, every part of your financial picture finally works together. The result is clarity, control, and protection that most plans fail to deliver.

Build Wealth, Protect Your Legacy!

tax-free lifetime passive income & small business pension specialists

TAX-FREE LIFETIME PASSIVE INCOME &

SMALL BUSINESS PENSION SPECIALISTS

We don’t just talk about financial freedom, we teach you how to achieve it. Our tailored strategies empower individuals, families, and business owners to build wealth, minimize taxes, and secure their legacies for future generations.

The WealthQuant Blueprint: The Process High Earners Wish They’d Started Years Ago

A proprietary 4-step process to uncover missed opportunities, bring clarity to your entire plan, and give you long-term control without the stress of coordinating everything alone.

1

Strategic Discovery

We begin with a focused, high-level conversation to reveal blind spots in your tax exposure, income planning, and legacy structure. Many clients are surprised by what has been hiding in plain sight and what others may have overlooked.

2

Coordinated Blueprint

Your personalized plan is built by WealthQuant’s expert team in partnership with our trusted CPAs, estate attorneys, and licensed professionals. Every component is designed to work together seamlessly from the start.

3

Guided Execution

Implementation is led by us, not left to you. We turn your blueprint into action with precision, clarity, and ongoing guidance so that you can move forward with confidence and without unnecessary complexity.

4

Long-Term Alignment

As your life and goals evolve, your plan should too. We review and adjust your strategy regularly to help it stay efficient, compliant, and ready to support your next chapter.

Wondering If You're Missing Something Big?

Discover how WealthQuant helps high earners reduce tax exposure, align their financial team, and take control of their financial future through a coordinated process built for long-term success.

Let’s start with a focused conversation about what matters most to you.

4-step plan to build tax-free lifetime passive income

Schedule a Demo to Get Your WealthQuant Blueprint!

Schedule a session with us today and start your journey toward a Tax-free Lifetime Passive Income.

Simply click the button below to view available dates and book your appointment.

BUILT TO SIMPLIFY. DESIGNED TO ALIGN.

WealthQuant brings together trusted CPAs, estate attorneys, insurance experts, and financial professionals into one coordinated strategy. Our process is designed to reduce tax exposure, protect your assets, and simplify your life.

Wealth Isn't Just Built. It's Engineered.

Our data-driven process uncovers overlooked strategies to reduce taxes, protect income, and simplify wealth planning. Whether you're preparing for retirement, succession, or a liquidity event, we help you gain clarity and control. We coordinate with trusted CPAs, estate attorneys, and licensed professionals to ensure your plan is fully aligned and built to last.

Advanced Strategies to Protect, Grow, and Simplify Your Wealth

Your financial picture is complex. We bring clarity by aligning proven strategies, coordinating licensed professionals, and uncovering opportunities most high earners overlook so you can move forward with confidence.

Tax Optimization Strategies

Minimize capital gains, income taxes, and estate liabilities through coordinated tax strategies. By working closely with our trusted CPA and estate attorney partners, we design tax efficient plans that help preserve and grow your wealth now and for future generations.

Retirement Planning

Design a protected retirement income strategy that lasts. We explore index linked annuity solutions and qualified plans like Solo 401(k)s, defined benefit and cash balance plans, IRAs, and Roths to help reduce taxes, protect income, and support your lifestyle with peace of mind.

Asset Protection

Shield your wealth from lawsuits, long term care costs, and unexpected threats. We align insurance based strategies with your estate and tax plan to secure what you have built and keep your financial house in order.

Estate Planning

Ensure your legacy is protected and passed on according to your wishes. From tax efficient transfers to liquidity planning with life insurance, we structure your estate strategy in coordination with our trusted attorney and CPA partners to preserve, honor, and transition your wealth.

Charitable Giving

Maximize your impact with tax smart giving. Strategies like charitable remainder trusts provide immediate deductions, income for life, and long term legacy benefits. We coordinate with our trusted CPA and attorney partners to align giving with your greater wealth plan.

Business Succession

Exit on your terms with precision. We structure strategies like buy sell agreements, key person coverage, deferred compensation, and ownership transfers. These are coordinated with your legal and tax team or our trusted partners to ensure your business succession is efficient, compliant, and aligned with your long term goals.

TESTIMONIALS

What Our clients say about us

"Some of these things I had spent hours researching, but she knew the answers right away."

"Ginger helped me get a much clearer picture of my financial health and whether I was actually on track for retirement. I had been saving, but I didn’t really know when I could retire or if I was saving the right way. That uncertainty was always there, and it made it hard to know if I could actually enjoy my money now or if I needed to keep being overly frugal. She helped me step back and see the big picture. She showed me a projection of where I stood, which gave me a lot of peace of mind. I feel much more confident now that I’m on track, and I don’t have to stress about every little expense. She also helped me move an old annuity that wasn’t doing well into a better plan, and she introduced me to strategies like IULs and the Mega Backdoor Roth. Some of these things I had spent hours researching, but she knew the answers right away. Ginger is extremely knowledgeable, especially when it comes to tax-efficient strategies for high earners. She understands how to legally minimize taxes and maximize investments, which was exactly what I was looking for. If you’re a high earner and want a more strategic way to grow and protect your wealth, I’d highly recommend working with her. I found her advice to be very valuable."

- Tommy Yuan

"She holds both of us accountable for staying on track with real progress and regular check-ins"

"I can’t say enough good things about Ginger as my financial strategist. I’ve worked with a few advisors in the past, but they never lasted because their advice was all pretty generic. I’ve got the basics of my finances covered, and Ginger took the time to really understand my goals and offer strategies and options that went far beyond the usual advice to help me reach some pretty ambitious targets. On top of that, Ginger takes the time to explain complex financial instruments in a way that makes sense to me. It’s clear that she wants me to fully understand the decisions we’re making together. It feels like we’re partners in this process, and she holds both of us accountable for staying on track with real progress and regular check-ins. I really appreciate the time and effort she puts into making sure we’re headed in the right direction."

- Jamie Chou

"Her deep knowledge and personalized approach made the process smooth and easy to understand"

"I had the pleasure of working with Ginger at WealthQuant, and I couldn’t be more grateful for her guidance. She not only helped me plan my life insurance but also provided invaluable insights into retirement planning, wealth, and portfolio strategies. Her deep knowledge and personalized approach made the process smooth and easy to understand. Thanks to her expertise, I now have a solid financial plan that aligns with my long-term goals. I highly recommend WealthQuant to anyone looking for a trusted partner in financial planning!"

- Felix Lin

our Financial Clarity Starts Here

The WealthQuant Blueprint is a proven, step-by-step process to organize your financial world, align your tax, estate, and protection strategies, and give you confidence in your next decisions.

Schedule your introductory Blueprint session today. In just 45 minutes, we’ll listen to your goals, review your current picture, and outline how we can help simplify, align, and coordinate everything.

No cost. No pressure. Just clarity.

What Our clients say about us

Ginger helped me get a much clearer picture of my financial health and whether I was actually on track for retirement. I had been saving, but I didn’t really know when I could retire or if I was saving the right way. That uncertainty was always there, and it made it hard to know if I could actually enjoy my money now or if I needed to keep being overly frugal. She helped me step back and see the big picture. She showed me a projection of where I stood, which gave me a lot of peace of mind. I feel much more confident now that I’m on track, and I don’t have to stress about every little expense. She also helped me move an old annuity that wasn’t doing well into a better plan, and she introduced me to strategies like IULs and the Mega Backdoor Roth. Some of these things I had spent hours researching, but she knew the answers right away. Ginger is extremely knowledgeable, especially when it comes to tax-efficient strategies for high earners. She understands how to legally minimize taxes and maximize investments, which was exactly what I was looking for. If you’re a high earner and want a more strategic way to grow and protect your wealth, I’d highly recommend working with her. I found her advice to be very valuable.

-Tommy Yuan

I can’t say enough good things about Ginger as my financial advisor. I’ve worked with a few advisors in the past, but they never lasted because their advice was all pretty generic. I’ve got the basics of my finances covered, and Ginger took the time to really understand my goals and offer strategies and options that went far beyond the usual advice to help me reach some pretty ambitious targets. On top of that, Ginger takes the time to explain complex financial instruments in a way that makes sense to me. It’s clear that she wants me to fully understand the decisions we’re making together. It feels like we’re partners in this process, and she holds both of us accountable for staying on track with real progress and regular check-ins. I really appreciate the time and effort she puts into making sure we’re headed in the right direction.

-Jamie Chou

I had the pleasure of working with Ginger at WealthQuant, and I couldn’t be more grateful for her guidance. She not only helped me plan my life insurance but also provided invaluable insights into retirement planning, wealth management, and investment strategies. Her deep knowledge and personalized approach made the process smooth and easy to understand. Thanks to her expertise, I now have a solid financial plan that aligns with my long-term goals. I highly recommend WealthQuant to anyone looking for a trusted partner in financial planning!

-Felix Lin

Frequently asked questions

What makes WealthQuant different from other financial advisors?

Most high-income earners and business owners overpay in taxes or miss key planning opportunities, not because they lack professionals, but because those professionals operate in silos. WealthQuant changes that.

We are a financial services strategy firm specializing in complex, tax-efficient planning through advanced financial strategies. Our virtual family office model brings together trusted CPAs, estate planning attorneys, and other licensed professionals to build a single, coordinated plan. We do not manage investments or offer tax or legal advice directly. Instead, we lead the planning process from start to finish, helping ensure every decision works together to reduce taxes, protect wealth, and support your long-term goals.

Do you manage investments or provide investment advice?

Most high-income earners overpay in taxes or miss planning opportunities not because they lack professionals, but because no one is looking at the full picture. While your financial advisor manages your investment portfolio, WealthQuant focuses on what often gets missed.

We specialize in advanced financial strategy. That means helping you reduce unnecessary tax exposure, protect wealth, and align your entire financial life around your long-term goals. We bring in our trusted network of CPAs, estate planning attorneys, and other licensed professionals to structure and deliver fully coordinated, IRS-compliant strategies.

We do not replace your advisor. We help make your overall plan stronger.

What kind of clients do you work with?

We work with high-income earners, business owners, and professionals who are tired of overpaying in taxes and feeling like their financial strategy is fragmented. Many of our clients pay six figures in taxes annually and are looking for ways to keep more of what they earn by coordinating their tax, legal, and financial planning more effectively.

We also serve individuals and families navigating complex financial milestones—such as large capital gains, retirement transitions, legacy planning, and business succession. Our clients value proactive strategy, peace of mind, and the confidence that comes from making long-term financial decisions with clarity and purpose.

How can I reduce my taxes legally and effectively?

If you're earning a high income but still feel like you're bleeding taxes every year, you're not alone. Many successful professionals and business owners overpay simply because their financial team isn’t coordinated.

At WealthQuant, we specialize in advanced tax-efficient strategies designed to reduce unnecessary tax exposure while staying fully compliant with IRS rules. We partner with experienced CPAs and estate planning attorneys to offer coordinated strategies like entity structuring, defined benefit and cash balance plans, Roth optimization, and other tax-advantaged tools tailored to your goals.

Whether we work with your current CPA or bring in one from our trusted network, our focus is to ensure your entire plan is aligned and that your advisory team works together—not in silos—to protect more of what you earn and support your long-term financial success.

Can you help me retire early?

If you're earning more than ever but still unsure when you can actually stop working, you're not alone. Many high-income earners delay retirement not because they can’t afford it, but because no one has shown them a clear, tax-smart path to get there.

At WealthQuant, we help clients pursue financial independence by designing strategies that may accelerate their ability to retire on their own terms. We coordinate with trusted CPAs, estate planning attorneys, and other professionals to structure income, savings, and tax strategies in a way that supports early work-optional living.

By aligning cash flow, tax planning, and long-term legacy goals, many of our clients are able to move closer to retirement sooner—while keeping more of their wealth in a tax-efficient structure.

What’s the best way to create tax-efficient retirement income?

Many high-income earners are surprised to find that their 401(k)s and IRAs come with significant tax burdens in retirement—just when they’re ready to start enjoying the wealth they’ve built.

At WealthQuant, we help clients create more tax-efficient retirement income streams by designing strategies that reduce future taxes, preserve capital, and provide flexibility. This may include Roth conversions, charitable giving structures, insurance-based solutions, and other planning tools tailored to your financial and legacy goals.

We coordinate closely with your CPA or tax advisor—or one from our trusted network—to ensure every strategy aligns with your long-term retirement and estate planning objectives. The goal is simple: keep more of your income, with fewer surprises later.

How much do your services cost?

We work primarily with high-income professionals, business owners, and families who want clarity, structure, and coordinated financial strategy.

Our fees are fixed and tiered based on complexity. Most clients start with the Strategy Blueprint, which includes education, modeling, coordinated strategy design, and a clearly outlined plan so decisions can be made confidently and intentionally.

For clients who would like our continued involvement, we offer optional services for coordination with CPAs, attorneys, and other professionals, as well as ongoing annual review support.

Before providing a specific fee, we start with a qualification conversation to understand your situation and determine whether our services are appropriate for your needs.

I already have a CPA. Why do I need WealthQuant?

Having a CPA is important, but it’s not the same as having a coordinated financial strategy. Most CPAs focus on compliance and filing, making sure your taxes are submitted correctly. However, many do not proactively offer strategies to reduce tax exposure or coordinate across your full financial picture.

In fact, many clients come to us after realizing they were the ones researching ideas and bringing them to their CPA, only to see strategies misfiled or missed altogether.

At WealthQuant, we work in partnership with trusted CPAs and estate planning attorneys to help clients explore advanced planning strategies that align with their long-term goals. We do not provide tax or legal advice, but we collaborate closely with licensed professionals to ensure any recommended strategies are compliant, aligned, and implemented properly. Our role is to guide the strategic conversation and ensure your full advisory team is working together efficiently to protect and grow your wealth.

How do I get started?

We start with a complimentary discovery call to learn about your goals, challenges, and financial priorities. From there, if it makes sense, we’ll connect you with one of our trusted CPA partners to explore personalized, tax-efficient strategies that may help reduce your tax burden, accelerate retirement timelines, or protect long-term wealth.

This collaborative approach ensures that every recommendation is aligned with your full financial picture—no silos, no guesswork. If it's the right fit, we’ll guide you through the planning process in coordination with licensed tax and legal professionals.

© Copyright 2026 WealthQuant Financial Services and Insurance Solutions - All Rights Reserved.

Privacy Policy | Terms & Conditions | Disclaimer | DMCA

This website is operated and maintained by WealthQuant Financial Services and Insurance Solutions. Use of the website is governed by its Privacy Policy and Terms & Conditions

.